How to Manage Stakeholder Expectations across ESG Risk Management

In order to manage Stakeholder expectations across ESG Risk Management, it is important to undertake detailed research through a deep dive review across all stakeholders relevant to the organisations risk profile including regulators, customers and investors.

Stakeholder analysis is often considered the first step in strategic planning activities on an organisational level. The concept of stakeholder awareness and the need for analysis is prevalent among project management principles. This is equally applicable to ESG and particularly relevant for managing climate change risks but with a differing set of requirements / expectations.

Over the coming weeks I will provide specific articles across different stakeholder groups to explain the relevance and importance in the context of ESG Stakeholder Mapping.

Stakeholder Mapping

An approach to ESG related risk based on stakeholder expectations has many advantages. It facilitates a full and thorough validation of the core processes of the organisation (strategic, operations and compliance) while considering expectations that each stakeholder places on each core process. An important aspect of managing an organisation is balancing the various stakeholder expectations. There are challenges inherent in achieving this balance, and a risk identification procedure based on analysis of stakeholder expectations is the most robust way of ensuring that these challenges are recognised, analysed and minimised.

Stakeholder expectations are shifting and there is a strong customer and investor focus today on corporate purpose, fulfilling regulatory requirements and pledging to meet emissions targets. It is becoming increasingly apparent that, as well as profit, non -financial key performance indicators such as ESG ratings, customer satisfaction etc are also going to be important drivers for stakeholders (including lenders, pension funds, insurers, shareholders, regulators and consumers).

Range of Stakeholders

Organizations will have a wide range of stakeholders, some of whom may indeed be unwanted as far as the organization is concerned. International Organisation for Standardisation (ISO) Guide 73 defines a stakeholder as, a ‘person or group concerned with, affected by, or perceiving themselves to be affected by an organization’. For organisations in different sectors, the range of stakeholders will be different.

For government agencies, the general public will be a major stakeholder. Specific groups within the general public will be stakeholders in different agencies, depending on the purpose of each particular agency. For organizations that have significant environmental interests or exposures, a different range of stakeholders would need to be considered. For energy or mining companies, environmental pressure groups are higher profile key stakeholders.

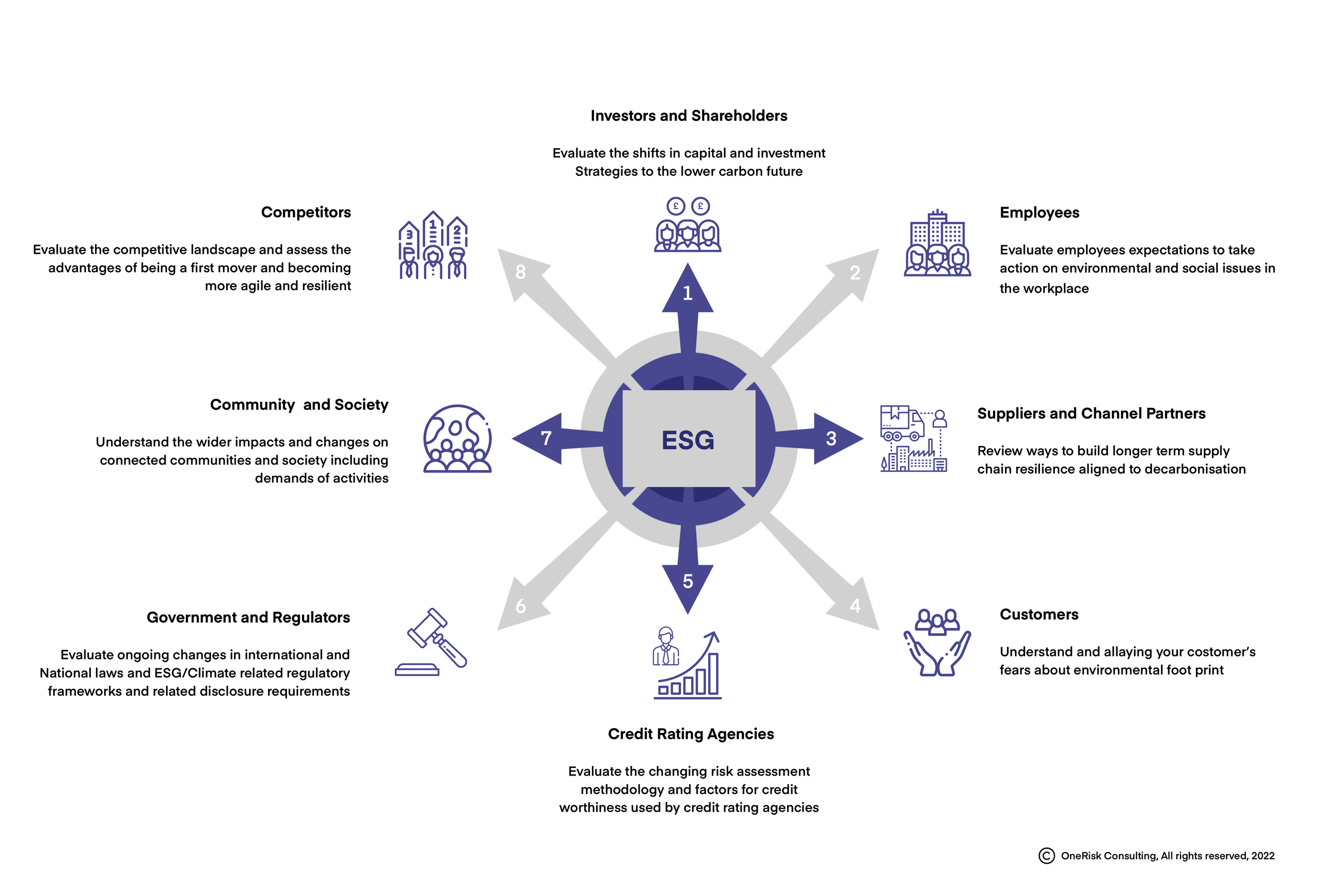

The diagram below* provides a depiction of the main stakeholder groups who may have requirements / expectations with regards to ESG and Climate Change. It is not a definitive list and will differ depending on the industry in which your organization operates, the size and ownership structure of the firm, the value-chain of your service / product offering and the strategic objectives.

Stakeholder Mapping Tool

Stakeholder mapping is a great management tool to help assess the stakeholder expectations of investors, customers, rating agencies, employees etc in terms of importance and ability to influence or control them this will lead to healthy internal discussions and support the identification of a range of risks and opportunities and ultimately support actions that will guide the company in terms of immediate focus areas or where external assistance may be required

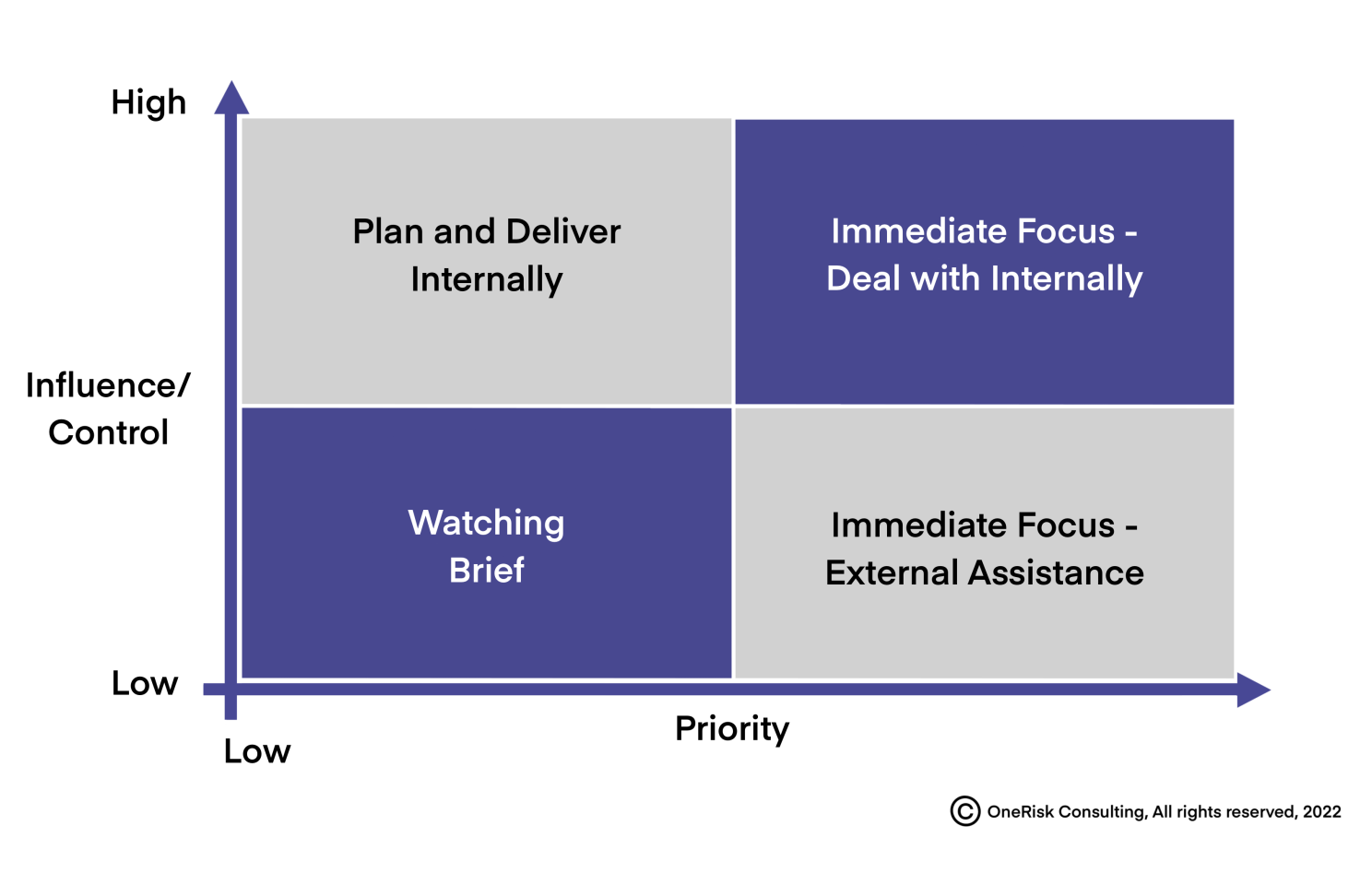

Framework to Prioritising Climate Stakeholders

In order to assist in assessing the stakeholders of the organization relative to each other and the action required (and by whom), we outline in Figure X a simply two-by-two matrix that can used in which stakeholders can be mapped out in terms of priority to the organisation (i.e. low / high) and influence or controllability by the organisation (i.e. the influence / control the organisation has over that stakeholder group). This acknowledges that all stakeholders are important but recognises that depending on a number of variables their relative importance will differ across organization’s (i.e., variables could include the size of firm, the industry in which it operates, the ownership structure, the point in the business cycle and the regulatory environment). Stakeholders may move between these boxes depending on these variables over time.

Prioritisation of Stakeholders

For example, a high priority stakeholder over which a firm has more influence at a point in time could be employees that have developed an innovative new low-carbon product. In an ideal world, this could be dealt with immediately using in-house resource.

Alternatively, a high priority stakeholder that the organisation has less influence over could be a regulatory body or the actions of competitors. These would still require immediate focus but there needs to be recognition that the relationship dynamic and levels of information may differ and there may be instances where external expertise would be beneficial (examples being external Legal Counsel ahead of a significant regulatory change relating to climate change or the use of external consultancy to understand changes in consumer demands within the wider competitive landscape).

Strategic Planning

In summary stakeholder analysis should be considered as one of the key first steps in strategic planning activities and developing an overall climate strategy and ongoing implementation plans. Organisations therefore need to research and understand the internal and external expectations of key stakeholders such as regulators and factor these into their risk management and decision-making processes.

An adequate risk identification and assessment process for climate risks should address key portfolios, geographic areas, related to products and services of the organisation but need to be tailored depending on the size, nature and complexity of the organisation involved.

Written by Martin Massey